If you are looking to boost your portfolio with with a long term growth stock, Ford would probably not be a good fit.

If your portfolio could use a reliable good dividend, Ford is worth taking a closer look at.

Why Ford is not a good growth stock.

In the past 10 years, Ford has produced a negative total return of 3%. While the S&P 500 generated a total return of 254%. Looking ahead into 2025 Ford is facing several headwinds.

Fords EV (Electric vehicle) segment is a big drag on the company.

EV demand is down, causing Ford to scale down it's EV production. EV demand will likely rise in the future, but Tesla dominates the market by a significant margin. Furthermore, some people are not wanting to jump straight into EV vehicles and opt for a hybrid version sold by Toyota.

Warranty issues will continue to persist throughout 2025 and probably beyond.

Quality issues in several models from 2016-2021 have led to an $800 million increase in warranty costs. Though management intends to address these issues, they have communicated to shareholders that the problems may not be resolved for more than a year, at the very least. In other words, the warranty issues will cause a bearish overhang in the stock for the foreseeable future.

Tariff Concerns

Ford CEO voiced concerns about tariffs saying, “So far, what we’re seeing is a lot of cost and a lot of chaos. If you look at the tariffs, let’s be real honest, long term, a 25% tariff across the Mexico and Canadian border will blow a hole in the US auto industry that we have never seen.”

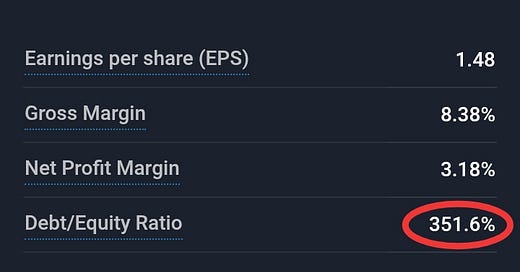

Debt to equity ratio is extremely high.

A debt-to-equity ratio of 351.6% is considered extremely high and indicates a company is heavily reliant on debt, posing a significant financial risk as it suggests they have three times more debt than equity, which could make it difficult to meet debt obligations and could potentially lead to bankruptcy if business conditions worsen; this is generally seen as a very unhealthy financial situation for most companies, and investors would likely view it with major concern. For comparison Tesla has debt ratio of 10.7% and Toyota 110.2%

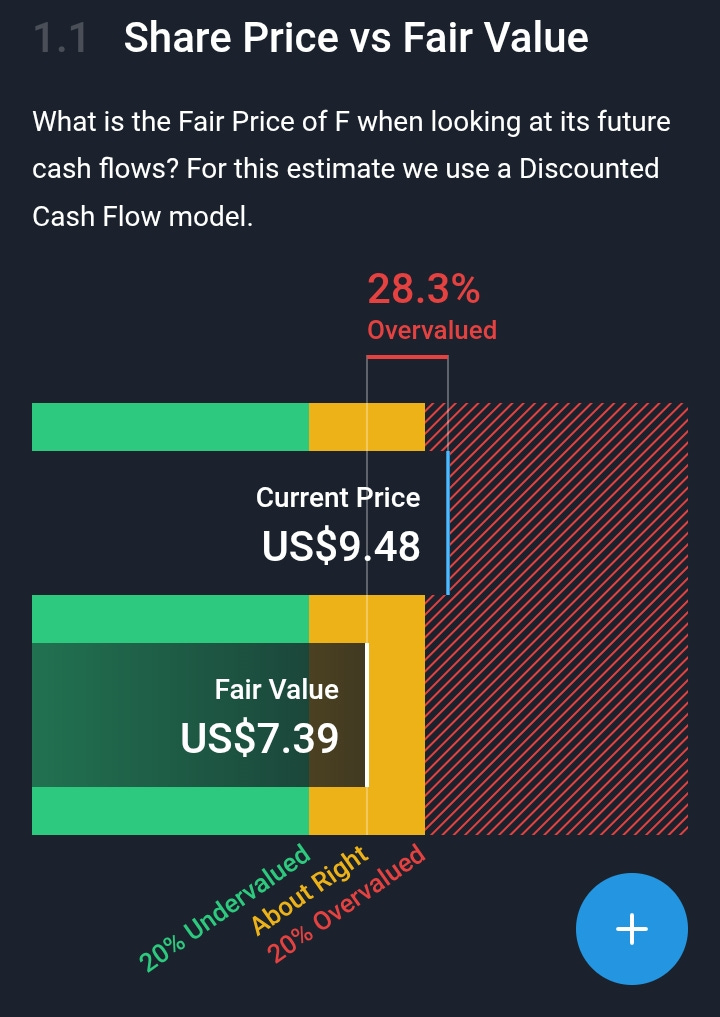

Ford is currently overvalued 28.3%

Fords dividend offers good income to your portfolio.

While there is gloom hanging over Ford's growth, it's sunny skies on the dividend side. Ford's robust 7.9% dividend yield, good payout ratio, earnings and cash flow coverage make it an attractive dividend stock.

The safest dividend payout ratio has been around 41%, according to research by Wellington Management and Hartford Funds.

This payout ratio allows Ford to pay an attractive dividend, while also retaining a significant amount of cash. The extra cash can be used to boost EV or debt repayment.

The 1.1% buyback yield could suggest Ford is focusing on other priorities, such as reinvesting profits into the business or reducing debt.

Earnings Payout to shareholders.

Earnings Coverage: With its reasonably low payout ratio 41% , Ford's dividend payments are well covered by earnings.

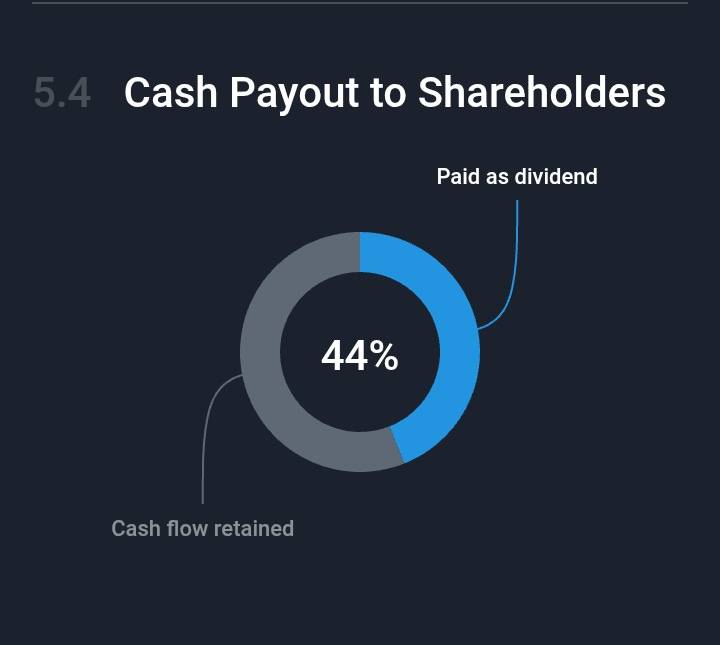

Cash payouts to shareholders.

Cash Flow Coverage: With its reasonably low cash payout ratio 44%, Ford's dividend payments are well covered by cash flows.

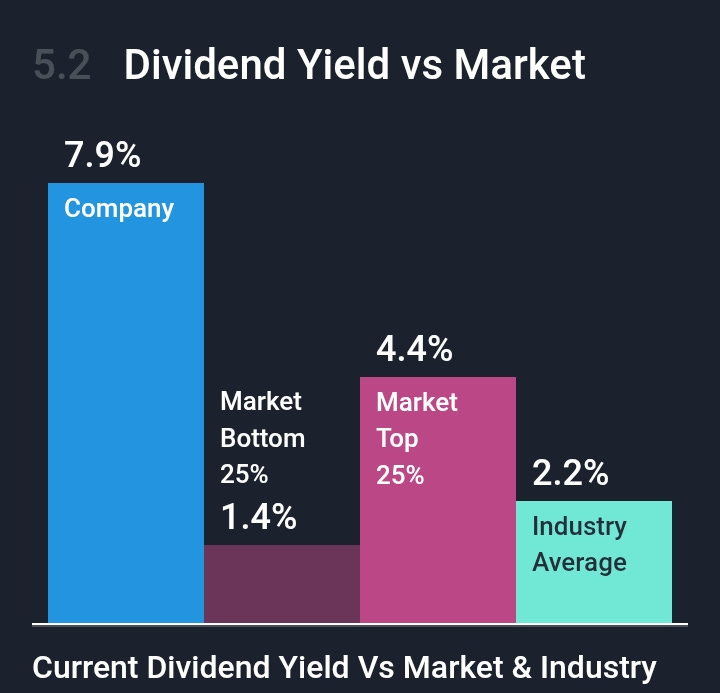

Dividend yield vs market and industry.

Notable Dividend: Ford's dividend (7.91%) is higher than the bottom 25% of dividend payers in the US market (1.43%)

High Dividend: Ford's dividend (7.91%) is in the top 25% of dividend payers in the US market (4.45%)

So is Ford worth buying right now?

Above, I outlined some of the doom and gloom Ford will likely face in 2025. How much of that is baked into the stock remains to be seen.

Last week Ford reported financial results for the three-month period that ended December 31. Revenue rose 5% to $48.2 billion, with adjusted diluted earnings per share increasing 34%. These headline figures came in ahead of Wall Street analyst estimates, which is an encouraging sign. However the stock priced dropped as Wall Street seems to be looking into the future of 2025.

I would not buy Ford for a growth stock for reasons above. I also would not buy Ford as a dividend stock right now, and here's why.

The ex dividend date for Ford's dividend is today, February 18, 2025. A stock needs to be purchased a day before the ex dividend date for you to reap the upcoming dividend.

A wait and see approach.

A lot can happen in the next few months before the next dividend. I would keep Ford on my radar, and continue to watch, and revaluate the situation around the next earnings report. I think things will dip for Ford before they raise again, if this is the case, you would get Ford at a better price, and have a shorter time to collect a dividend.

I will leave you with a great tool to see exactly how much your next stock sale will net you after taxes. It also shows the difference you would earn if you sell a stock before or after owning for a year.

Click below for the stock tool

https://smartasset.com/investing/capital-gains-tax-calculator